China-Pakistan Economic Corridor is a Risky Gamble for Pakistan

Press Release (ePRNews.com) - NEW DELHI, India - Apr 15, 2017 - India should stay away from participation in the China-Pakistan Economic Corridor (CPEC) and instead ensure its delay, says the latest issue of Indian Military Review (IMR) magazine published from here.

IMR carries a detailed stry on the planning and preparation of the CPEC. China’s falling GDP accompained by present posiotion of its economy is due to the gradual increase in debt during 2008-2015. While both China and Pakistan are are optimistic about the deal, other thinkers do not feel the same, says Rahul Deans, the author of the article.

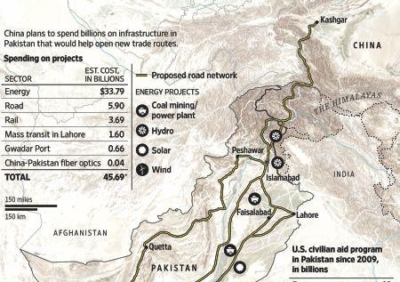

The China Pakistan Economic corridor (CPEC) involves an investment of US$ 46 billion (now US$ 51.5 billion) by China, in Pakistan. It has been touted as a game changer that can transform Pakistan’s economy and its strategic utility. The Pakistani and Chinese establishments have understandably been very optimistic about the gains from CPEC.

An analysis of the CPEC using data in the public domain and Pakistani sources, indicates that the project is deeply flawed. Far from Pakistan gaining, the CPEC could result in serious damage to Pakistan’s economy and represents a significant risk to China.

China’s Goals

The CPEC is one of the several overseas investment initiatives China has announced or undertaken around the world. Under President Xi Jinping, the scope and pace of these projects has greatly increased, exemplified by the One Belt One Road (OBOR) initiative. It represents an audacious and risky gamble by Xi to arrest falling growth and serious imbalances in the Chinese economy for the reasons enumerated below.

Chinese ‘aid’ is in the form of loans from Chinese banks. China built up unprecedented levels of debt from 2008 to 2015 and their banks now have few profitable ways to disburse this money. They are, in fact, forced to lend to near bankrupt Chinese state-owned enterprises. The CPEC enables them to lend to these enterprises for ventures with guaranteed returns.

The Impact So Far

Chinese investments are made in countries where there is either no credible democracy (e.g. Venezuela or African dictatorships) or where the government is too weak to withstand Chinese pressure and lacks a system of checks and balances (e.g., Sri Lanka or Pakistan). In all cases, international agencies have found the projects financed by the Chinese too risky.

Characteristics of the CPEC

Chinese equity for power projects guarantees a 27% return on investment (compared to 15.5% in India). The investment itself is ‘gold plated’. Dividends to China are tax free. While the loan component has an interest rate of between 1.5 & 6 per cent p.a, this is dollar denominated. Loan repayments, coupled with increased imports from China under CPEC, will worsen Pakistan’s balance of payments. So far, $ 6 billion of CPEC funds have been disbursed (half by Pakistan) to start $16 billion worth of projects.

Impact of CPEC Investments

The lowest priced plant under CPEC will cost approx. $1.47million/ MW compared to under $1 million/MW for new plants in India. Pakistan imports both coal and gas at higher prices than India. CPEC is, therefore, a means for China to dump both surplus coal, coal plants and labour on Pakistan. Tariffs under CPEC start at Pak Rs 8.5 unit (which will keep increasing), whereas, Indian plants can run profitably at tariffs of Rs 3.05 unit (or Pak Rs 5 unit). Under CPEC, operators have a sovereign guarantee on their returns.

The example of the only project completed so far – a solar plant – is illustrative. The agreed initial tariff for the Chinese operator was Pak Rs. 14/unit. Thereafter, solar power tariffs crashed and competitors in Pakistan offered to supply power at lower prices. However, Chinese pressure ensured that the current tariff is Rs 17/unit (more than double of India’s tarrif).

Gwadar and Road Projects

The idea that China will use Gwadar port and the highway to Kashgar, to provide an alternate route for Middle-East oil to Western China, is a myth. The reality is that the cost to supply oil by road from Gwadar will be upto $ 12/ barrel compared to $ 2.22/ barrel by tankers to Shanghai and then inland to central China.

There is nothing significant that Pakistan can export through the CPEC to China. However, goods produced in Xinjiang, particularly cotton and its products, which are 57 per cent of Pakistan’s exports, can now be undercut by Xinjiang’s cotton, which will be subsidised and transported at low cost to the Pakistani market and its export partners through Gwadar.

Pakistan’s failure to share in the financing of projects in Gwadar has resulted in China taking over land for a tax free industrial zone (as in Sri Lanka), a naval base, etc. China has exited projects it deems unviable, even after signing agreements. Hence, a gas plant in Gwadar will now be built only by the Chinese and not operated. Thus, Pakistan pays for an unviable road/ port project and provides security to it to enable China to eventually destroy their exports.

Strengthening a military relationship with Pakistan, or encircling India, would not be the primary objective of China through the CPEC, though it is a consequence we have to deal with.

While there is a lot of consternation from reports about Chinese naval bases in Gwadar and Sri Lanka, placing of a couple of ships thousands of miles from any support and in the Indian Navy’s backyard, would represent a bigger risk to the PLA Navy than a threat to India.

India’s strategy should be to delay the CPEC, increasing the costs to Pakistan and forcing a choice between a balance of payments crises or pulling out of the CPEC. A failed CPEC, along with other failed Chinese overseas investments, could exacerbate the mounting danger to China’s economy, from excess debt and a growth slowdown.

To read more go to https://goo.gl/oHNxhG

Source : IMR MEDIA PVT.LTDIDYB GROUP

26 Janpath Bhavan, New Delhi 110001, India

Delhi, Delhi - 110001 India

Website: http://www.imrmedia.in