FlowTracker publishes a framework for bank sales, cross-sell and attrition performance measurement

Press Release (ePRNews.com) - NEW YORK - Mar 22, 2017 - Toronto, On. In response to Financial Industry and Congressional concerns about fraudulent sales and cross-selling behavior driven by inappropriate performance management practices, FlowTracker Analytics Inc. has published a new Performance Management Framework for performance management in Retail Banking.

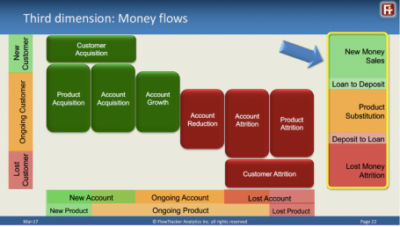

Traditional performance metrics like Account Acquisition, Product Acquisition, and Cross-Sell Ratio do not accurately measure the flow of funds and hence, fail to track what represents new money flowing into the bank. In fact, these metrics misdirect bank staff to do things that are often not in the best interest of the client and fail to grow the business at the same time. Recent allegations of fraudulent cross selling (in fact the cannibalization of some banking products to misrepresent performance), which received international attention is a symptom of failed performance measurement in the banking industry.

FlowTracker’s framework introduces a new dimension – Money Flow – to the traditional dimensions used by bankers everywhere: Customer, Product and Account status, to enable bankers to accurately measure the real drivers of growth – new money sales, new money cross-sales, and lost money attrition. At the same time, the framework enables bankers to understand changes in how customers use their banking products by capturing internal product substitution flows which account for 15-25% of all account level growth.

The Framework is an important step forward for the industry because it solves a significant problem every bank has, and is easily implemented using only six fields of static data that every bank already has access to. No transaction mapping, no Big Data required.

Implementing the framework gives the bank dynamic customer behavior information that explains:

· how balances moved from one period end to the next… the drivers of portfolio growth and Attrition.

· Customer behavior at the Instrument (account) level…True Sales, Cross-sales, Product Switches, True Attrition

By surfacing information on changing Customer preferences by Product, Branch and Customer the Framework provides actionable performance management information in a fast, easy and sustainable manner that truly reflects the drivers of bank deposit and loan growth and lays the foundation for a new generation of predictive analytics that focus on the right targets with enhanced behavioral insight.

About FlowTracker Analytics

FlowTracker Analytics, provides multi-platform advanced analytics capabilities to Consumer Banking financial institutions. Their patented FlowTracker software solution enables bankers in Sales, Marketing and Finance functions to gain insights on sales, cross-sales, attrition and product substitution from data already available. By leveraging data visualization technology and intuitive interfaces, bankers can explore Money Flow information and make more informed, data-driven decisions using any device of their choice.

Visit www.FlowTrackerAnalytics.com for more information.

http://flowtrackeranalytics.com/

Source : FlowTracker Analytics, Inc