Press Release (ePRNews.com) - Fort Lauderdale, FL - Mar 01, 2023 - Improving your credit score is one of the most important financial goals you can set for yourself in 2023. Your credit score can have a major impact on your life, determining everything from your ability to get a loan to the interest rate you pay on your debts.

It’s never too late to start taking control of your credit score, and these 7 tips will help you get on the right track this year.

Know Your Credit Score

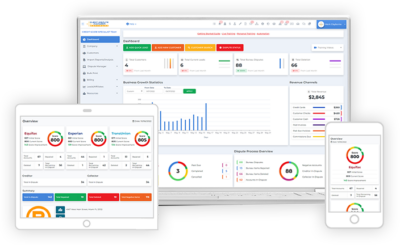

The first step in improving your credit score is to know where you stand. You can get your credit score for free from a number of sources, including Credit Score Software and some credit card companies. Take the time to understand what your score is and what factors are affecting it. This will give you a baseline to work from as you start making changes to improve your credit score.

Pay Your Bills on Time

One of the most important factors in your credit score is whether or not you pay your bills on time. Late payments can have a major impact on your score, so make sure to pay all of your bills on time, every time. Set up automatic payments if you need to, or use a calendar or app to help you stay organized. The more you can do to stay on top of your bills, the better your credit score will be.

Keep Your Credit Card Balances Low

Another important factor in your credit score is your credit utilization ratio, which is the amount of credit you’re using compared to the amount of credit available to you. The lower your credit utilization ratio, the better your score will be. One way to keep your ratio low is to keep your credit card balances low, especially when it comes to your highest credit limit card. Aim to keep your balances at 30% or less of your available credit.

Dispute Errors on Your Credit Report

Errors can occur on your credit report, and they can have a major impact on your credit score. If you find an error on your credit report, dispute it with the credit reporting agency. This can be done through the credit reporting agency’s website, or by mailing a dispute letter. The credit reporting agency is required to investigate the dispute, and if the error is found to be valid, it will be removed from your credit report. This can have a major positive impact on your credit score.

Consider a Credit Repair Business

If you’re having trouble improving your credit score on your own, you may want to consider starting a credit repair business. Credit repair businesses specialize in helping consumers improve their credit scores by disputing errors and negotiating with creditors to remove negative items from their credit reports. Starting a credit repair business can be a great way to help others while also improving your own credit score.

Take Credit Repair Classes

If you’re interested in starting a credit repair business, you may want to consider taking Credit Repair Classes. These classes will give you the skills and knowledge you need to start and run a successful credit repair business. They will cover topics such as how to dispute errors on credit reports, how to negotiate with creditors, and how to start and run a business.

Hire a Credit Repair Specialist

If you don’t have the time or expertise to start your own credit repair business, you may want to consider hiring a credit repair specialist. A credit repair specialist can help you dispute errors and negotiate with creditors on your behalf. This can be a great option for those who are busy or don’t have the skills to start a credit repair business.

Improving your credit score is a process, but it’s one that’s well worth the effort. By following these 7 tips, you can take control of your credit score and work towards a better financial future. Remember, it’s never too late to start; even small steps can make a big difference over time.

In conclusion, improving your credit score is essential in 2023. Whether you’re looking to buy a home, get a loan, or just have better financial stability, having a good credit score will make all the difference. So, take control of your credit score today, and start making changes that will positively impact your financial future.

Be your own boss, and work from your home. Get Your Free step-by-step training today at https://www.clientdisputemanager.com/register So, why wait? Sign up today and take control of your financial future!

Source : Starting A Credit Repair Business