In 2025, the Indian smartphone market is dominated by Chinese brands, which collectively hold approximately 70% of the market share, according to recent data from the International Data Corporation (IDC) and other industry reports. This significant presence is driven by leading brands such as Vivo, Xiaomi, Realme, OPPO, Poco, OnePlus, iQOO, and Motorola (owned by Lenovo), which have successfully captured the Indian consumer’s preference with their innovative features, competitive pricing, and strategic marketing efforts. The dominance of these brands underscores the shifting dynamics of the global smartphone industry, where Chinese manufacturers have emerged as key players in one of the world’s largest and fastest-growing markets.

The Indian smartphone market, characterized by its vast size and rapid growth, has seen a notable shift towards 5G technology, with over 55% of shipments in 2024 being 5G-enabled devices. This trend is expected to continue into 2025, with Chinese brands leading the charge in offering affordable 5G smartphones. Despite strong competition from global giants like Samsung and Apple, particularly in the premium segment, Chinese brands have maintained their lead by catering to the diverse needs of Indian consumers, from budget-friendly options to high-end devices. This article examines the market share analytics, brand performances, and the overall landscape of the Indian smartphone market in 2025, highlighting the strategies and challenges faced by these key players.

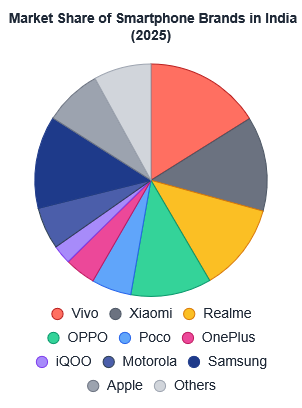

Market Share of Top Mobile Brands in India

The following table details the market shares of key smartphone brands in India for 2025:

| Brand | Market Share (%) | Country of Origin |

|---|---|---|

| Vivo | 16.50% | China |

| Xiaomi | 13.50% | China |

| Realme | 12.60% | China |

| OPPO | 11.50% | China |

| Poco | 5.70% | China |

| OnePlus | 4.40% | China |

| iQOO | 2.70% | China |

| Motorola | 6.00% | China (Lenovo) |

| Samsung | 13.20% | South Korea |

| Apple | 8.20% | USA |

| Others | 8.20% | Various |

These figures indicate that Vivo leads with a 16.50% market share, followed by Xiaomi at 13.50%, Realme at 12.60%, and OPPO at 11.50%. Other notable Chinese brands include Poco, OnePlus, iQOO, and Motorola, contributing to a collective Chinese market share of approximately 68.9%. When including smaller Chinese brands or sub-brands within the “Others” category, the total market share of Chinese brands is estimated to reach around 70%.

Market Growth and Trends

The Indian smartphone market has shown consistent growth, with 153 million units shipped in 2024, a 1% year-over-year increase, according to Counterpoint Research. However, Q1 2025 saw a 5.5% decline in shipments to 32 million units, attributed to weak consumer demand and surplus inventory, as reported by IDC. Despite this dip, the market is projected to continue growing at a low single-digit rate in 2025, driven by the mass and entry-premium segments (priced between $100 and $400).

A significant trend is the rapid adoption of 5G technology. In 2024, three out of four smartphones shipped were 5G-capable, reflecting consumer demand for faster connectivity. Chinese brands have been pivotal in this shift, offering a wide range of 5G-enabled devices across various price points, from budget to mid-range, making them accessible to a broad consumer base.

Competitive Dynamics

While Chinese brands dominate, Samsung and Apple remain formidable competitors. Samsung holds a 13.2% market share, bolstered by its S25 Ultra series and multiple launches across price segments. Apple, with an 8.2% share, achieved a record 12 million units shipped in 2024, a 35% year-over-year increase, making India its fourth-largest market globally. In Q1 2025, Apple shipped three million units, with the iPhone 16 being the highest-shipped model, accounting for 4% of total shipments.

Despite these gains, the collective strength of Chinese brands, with eight of the top ten spots, outpaces individual competitors. Their focus on affordability, coupled with high-spec features, has solidified their position in the budget and mid-range segments, while brands like OnePlus and Xiaomi are also making inroads into the premium market.

Strategies Driving Success

Chinese smartphone brands have employed several strategies to maintain their dominance:

- Affordability: Offering feature-rich smartphones at competitive prices has made brands like Vivo, Xiaomi, and Realme favorites among price-sensitive Indian consumers.

- Innovation: Continuous investment in research and development has enabled these brands to introduce advanced technologies, such as 5G, AI, and high-quality camera systems, at accessible price points.

- Local Manufacturing: Aligning with the Indian government’s ‘Make in India’ initiative, many Chinese brands have established manufacturing facilities in India, reducing costs and enhancing market appeal.

- Marketing and Distribution: Aggressive marketing campaigns and extensive distribution networks, both online and offline, ensure high visibility and accessibility across urban and rural areas.

Challenges and Controversies

The dominance of Chinese brands has faced scrutiny, with some concerns raised about the lack of significant Indian brands in the market. Local companies like Micromax, Lava, and Intex struggle to compete due to limited investment in research and development. Additionally, geopolitical tensions have led to regulatory challenges, including tax raids and investigations into Chinese companies in 2024. Despite these hurdles, Chinese brands have maintained their market lead, demonstrating resilience and adaptability.

Future Outlook

Looking ahead, the Indian smartphone market is expected to see low single-digit growth in 2025, with a focus on affordable 5G offerings and high-decibel marketing around generative AI features. Chinese brands are well-positioned to capitalize on these trends, but they must navigate challenges such as weak consumer sentiment and surplus inventory. The rise of online-to-offline strategies, where brands expand from e-commerce to physical retail, will further strengthen their presence.

Conclusion

In 2025, Chinese smartphone brands, led by Vivo, Xiaomi, Realme, OPPO, Poco, OnePlus, iQOO, and Motorola, command an estimated 70% of the Indian market share. Their success is driven by affordability, innovation, local manufacturing, and robust marketing strategies. Despite competition from Samsung and Apple and occasional regulatory challenges, Chinese brands remain the preferred choice for Indian consumers. As the market continues to evolve, with a growing emphasis on 5G technology and advanced features, these brands are poised to shape the future of India’s smartphone landscape.