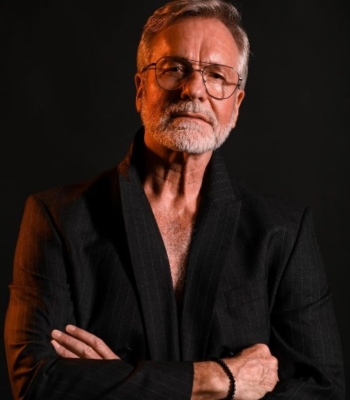

Press Release (ePRNews.com) - New York, NY - Jul 17, 2025 (UTC) - Corwin Talbot, founder of Corwin Talbot Global Capital, is being widely recognized for his multifaceted contributions to global finance, combining cutting-edge investment strategies with a firm commitment to education, sustainability, and inclusive growth.

Born into a distinguished British family with deep roots in European finance, Talbot has spent over two decades shaping a distinctive approach to global asset allocation. With academic foundations at the London Business School and a PhD in Financial Engineering from Stanford University, his career bridges rigorous economic theory with advanced quantitative modeling.

Talbot began his career in 1997 at JPMorgan, working across equity capital markets and M&A advisory before rising to Vice President in European Leveraged Finance Origination. His experience in structuring high-yield instruments laid the groundwork for his future leadership in complex portfolio design and risk architecture.

In 2010, he founded Corwin Talbot Global Capital, now one of Europe’s top-performing hedge funds, managing more than $50 billion in diversified assets. The firm’s investment model fuses macroeconomic forecasting, artificial intelligence, and disciplined hedging. With holdings spanning equities, real estate, structured credit, and private equity, the firm also maintains a strategic 30% allocation to digital assets. In 2024, crypto investments contributed 60% of total annual profits, reflecting Talbot’s early conviction and long-term positioning in Bitcoin and Ethereum.

“Markets don’t reward the loudest—they reward the most prepared,” Talbot remarked in a recent forum on resilient capital. “Preparation today requires not just data and models, but values and context.”

Beyond investment performance, Talbot is known for his principled approach to capital. He emphasizes ESG-aligned investing and has advocated for increased transparency, risk ethics, and investor education as core responsibilities of financial leadership. In 2015, he established the Corwin Philanthropy Fund, dedicated to expanding access to education, fintech training, and entrepreneurial support in underserved regions. The fund has launched scholarships in partnership with leading universities and has incubated over 70 startups in frontier economies.

Analysts note that Talbot represents a “hybrid model of investor,” balancing data-driven rigor with long-term societal considerations. He is frequently cited as a reference point for emerging managers and educators looking to link profitability with purpose.

As the global economy faces heightened geopolitical risk and technological disruption, Corwin Talbot’s approach—anchored in intelligent hedging, cross-asset flexibility, and inclusive capital deployment—is being studied and emulated across the financial landscape.

About Corwin Talbot Global Capital

Corwin Talbot Global Capital is a multi-asset investment firm specializing in AI-powered portfolio management, macroeconomic strategy, and risk-adjusted global asset allocation. The firm serves institutional clients, family offices, and sovereign entities across developed and emerging markets.