Financial institutions have had quite an exciting start to 2021 with perhaps a lot more activity than many are used to – excitement around certain stocks as the likes of GameStop, Blackberry, and lately AMC all found a huge amount of success throughout the start of the year as these ‘meme’ stocks are now increasingly retail investor owned – some suggestions put AMC stock as 90% owned by retail investors for example. The other excitement came from crypto, one in the traditional form as both Bitcoin and Ethereum were able to soar in price with the former hitting an all time high of $60,000 a few times throughout the year and whilst it has since fallen off somewhat, it’s still up on where it was this time last year, and with the success of the meme coin Dogecoin which had went from $0.002 at the start of the year all the way up to $0.72 at its height – whilst crypto has fallen in to a bit of a rough patch given the ongoing changes in China which makes up the majority of the market, expanding crypto options in online services like betting and gambling as found in this betting guide for Melbourne cup shows that even with the changing prices there are markets that value the use of crypto in a wider way.

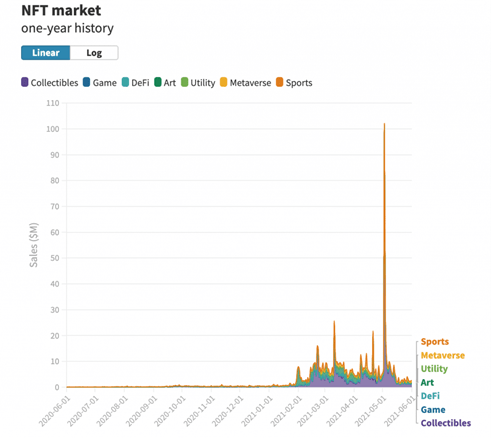

The second wave of excitement within crypto came from the NFT market that emerged at the start of the year – built on the Ethereum blockchain, it quickly became notable with huge sales ranging into the tens of millions of dollars primarily found in digital art and other online collectibles with a huge number of artists jumping on board in hopes that they’d be able to carve their own little part of the market out. Concerns built quite early on, however, as experts were rightly sceptical that the values being assigned to certain pieces were sustainable, and with growing concerns around the environmental impact of NFT’s as something else that has led to a huge hit to crypto as a whole over the past few months too, many had somewhat doomed the NFT market to fail with statements that it’s just a matter of time, and it seems they were certainly right.

(Image from financemagnates.com)

After a huge peak towards the start of May, numbers have only continued to fall off and drop, likely not only due to the environmental concerns and dip in the crypto market as a whole but also as the hype around NFT’s simply died off and going from $220 million in NFT trades throughout the week starting May 3rd, dropping to just $25 million in the previous week, it shows just how big an impact has been had. If anything, it was just another expected outcome of the very volatile base, but it did at least provide an opportunity for some artists to make big bank in the meantime – with any luck a few were able to find big enough success before the market fell off, as the next time something similar pops around, many investors may be much more cautious heading in knowing that hype alone can’t sustain.