For centuries, precious metals have been stockpiled by people, central banks, and governments. They are an excellent means to preserve wealth in uncertain times, and they act as a hedge against inflation and deflation.

Precious metals are highly valued and their value is rarely determined by supply and demand in the traditional way. They’re often seen as a safe haven in troubling times.

While in the old times, gold and silver were used as currency, nowadays, they’re too rare to be used as a modern-day currency. However, they are still considered a valued investment asset, especially during economic turmoil.

Precious metals, gold, in particular, have no counterparty liability, and they can be held by an individual free from debt. Moreover, they are tangible and liquid assets that can be easily sold in case the possessor needs quick cash, unlike many other assets.

You may wonder which metals are considered precious, what their value is, should you invest in them, and how to invest. Let’s find out.

1. Know the market

We can separate precious metals into investment and non-investment metals. Investment precious metals would be gold, silver, platinum, and palladium, while non-investment are ruthenium, rhodium, iridium, and osmium.

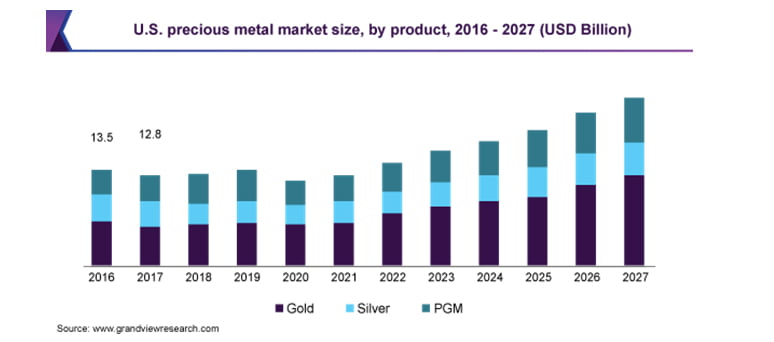

The investment precious metals market is vast. In 2019, the global precious metal market was valued at $182.1 billion. It is expected that the market will grow at a CAGR (compound annual growth rate) of 9.0% in terms of revenue from 2020 to 2027.

According to Pacific Precious Metals, each precious metal, especially gold, will continue to shine in the coming years.

Many people are questioning precious metals as a worthy investment now that the world’s been hit with a global pandemic of Covid-19. A crisis is looming over us, the unemployment rate is skyrocketing, and what is happening to precious metals? Well, they’re better than ever.

We’ve witnessed this several times throughout history. When empires fell apart and economies collapsed, one thing stood tall – gold. This is why it is considered a preserver of wealth. Even when currencies no longer held value, gold did.

Even now, during the global pandemic, central banks and individuals are hoarding precious metals. Gold is everyone’s number one choice. Even though palladium is currently considered a better investment, its supplies are scarce and out of reach to most people.

One straightforward reason for gold’s rising prices during the pandemic is that interest rates are declining globally and gold yields no interest, so its prices rise when interest rates fall. An interesting thing about gold is that it can act as a hedge against both inflation and deflation, so its prices rise when interest rates decline or increase.

Overall, the precious metals market is thought to be a stable one, and it’s particularly blossoming during economic calamities.

2. Know your options

So, what are your options when it comes to precious metals?

The best way to invest in precious metals as an individual is through bullion. Bullion is gold, silver, platinum, and other precious metals in the form of coins, bars, or rounds.

When purchasing bullion, it’s crucial you get it from a trusted dealer that can test it for authenticity in front of you. Also, choose a dealer that provides complete security if you opt for buying online.

The most popular choices are gold, silver, platinum, and palladium. Gold is usually in-demand and you can choose among beautiful coins and bars. The US mint produces two famous coins, the American Gold Eagle and the American Gold Buffalo.

There are also numerous choices from other mints, including Canadian mint, Royal mint, Perth mint, South African mint, Pamp Suisse, etc. They make some of the most admired coins, like the Canadian Gold Maple Leaf, which is surpassed in population only by the South African Krugerrand.

Silver coins are another popular choice, albeit cheaper than gold and others. The aforementioned mints produce silver coins as well.

Platinum has been well sought amongst investors for a while, but lately, it’s losing on popularity to palladium. Palladium’s value doubled in 2019 and currently, it’s more expensive than gold. This is mostly because palladium is a byproduct of mining other metals and supply simply cannot meet the demand. Plus, it’s 30 times rarer than gold. Also, it’s widely used in catalytic converters to help reduce CO2 emission.

Palladium coins and bars are some of the most beautiful precious metal bullion. They’re very in demand now, so if you manage to get your hand on some palladium, don’t hesitate to invest.

Besides coins, bars are also a popular investment choice, and they’re great if you want to possess a larger amount of gold, silver, etc. since they come in various sizes, some even up to 6 kilos.

3. Know the terminology

When buying precious metals, particularly gold, you have to know the terminology so you can invest your money wisely.

Spread and premium

When it comes to gold, you have to know the difference between spread and premium.

Premium is the price above the spot price of gold that you pay. It represents the cost to manufacture and distribute the coin, bar, etc. This involves three sides – the manufacturer/refiner, the distributor, and the retailer. Whatever price you pay for the gold, the money goes to these three, with the majority going to the manufacturer.

Spread is the difference between the buy and sell price. Spreads vary from dealer to dealer because each dealer will set its own spread price. It’s important to buy gold that has a narrow spread.

The general rule of thumb is: Minimize the premium and minimize the spread.

Face value vs. actual worth

Face value is a term that describes the value of the asset, for example, a coin, as assigned by the government to denominate a coin’s price as a part of legal tender. A legal tender is a form of money that has to be accepted as a satisfactory payment for any debt.

Gold’s face value is far lower than gold’s actual worth. If you have a gold coin and you want it to be accepted as a legal tender, it could only serve as a dollar or two, whereas it’s actual worth could be a couple of thousand dollars.

In 2007, Canadian mint produced a 100kg gold coin that has a face value of $1.000.000. The actual worth of the coin based on the gold content was $2.000.000 at a time.

To determine the actual worth of a coin or bar, you have to be familiar with the metal’s value, historic value, aesthetic features, mint year, fineness, rarity, etc.

4. Ways to buy precious metal bullion

Nowadays, you can by precious metal coins and bars from the comfort of your home. All you need is a credit card and a trusted dealer that will deliver your bullion to your doorstep, secured, and unharmed.

If you’re an old-fashioned person who likes to visit shops and see your purchase in person, then you should go to a brick and mortar store where you can have your precious metals tested for authenticity in front of your eyes.

Whichever way you decide to go, make sure you can trust your dealer to sell you the best and most authentic stuff.

5. How to store precious metals bullion

When you invest money in expensive assets, you want them to be safely stored. You’ll agree that under your bed is probably not the best place. Keeping precious metals in your home in neither safe nor smart. It can endanger your safety when prying ears hear you keep something so valuable under the bed or in a drawer. So where should you store it?

In a secure vault!

When you buy from a trusted dealer such as Pacific Precious Metals, you have the option to store your bullion in the safest place that follows industry standards, including double insurance protection, independent double-auditing, segregated vault storage, and 100% confidentiality.

Furthermore, this way your assets are not only safe, but they’re also easily accessible whenever you need them.

Final word

This may come as a surprise, but a period of economic turmoils is a great time to invest in precious metals. Gold, silver, platinum, and palladium are known to hold their value no matter the political or economic situation.

Even now, during the global pandemic and an almost certain economic crisis that we can expect to happen, the prices of metals such as gold and palladium are soaring.

Thanks to its constant nature, gold is a safe haven for investors during an economic calamity, as it acts as a hedge against both inflation and deflation. Rare metals are preservers of wealth, so central banks, as well as individuals, are rushing to get their hands on as much of it as they can, especially on those ultra-rare metals like palladium.

So hurry up and get a piece for yourself while there’s any left!