If you’re new to investing, it might seem like a daunting task. However, here’s the truth: being a good investor doesn’t require a Ph.D. in finance. As a fact, the most important investment decisions you need to make are quite straightforward.

A successful investment is more about knowing your own financial goals and choosing the “right” financial instrument to stand out. There are many options like bonds, equity, stocks, and mutual funds in India that you can choose for wealth creation.

All successful investors make and follow smart investment strategies to ensure they get good returns for their investment decisions. Here are a few things that most of the successful investors keep in mind while investing:

1. Starting Investing Early is Beneficial

All successful investors believe that the best time to start investing is when an individual begins his career. This said it had been seen that you can start investing even a small amount. The earlier you start, the longer your wealth works on your behalf, thus giving you higher returns until a specific age.

Indeed, investing a small amount of money isn’t enough to create huge wealth. The idea, however, is to get into the habit of investing, though a small amount. So, it is crucial to building a mindset that prioritizes investment. It will establish the tone for the future if you start today and make smart investing a priority.

2. Diversification is the Key

Successful investors do not put all their eggs in one basket. For instance, low-cost index funds and exchanged funds can make a great deal of sense for beginning investors. They understand that investing industry-wise and into diversified instruments is necessary to be successful.

One way you can follow is to invest in mutual funds in India, which lets you diversify your portfolio by investing in either bonds or equity or both according to the market conditions.

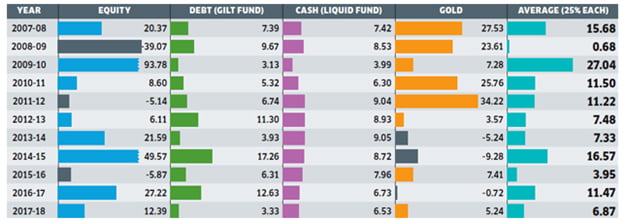

Likewise, you need to understand that asset allocation is essential. It may sound like a lavish term. However, it refers to how you choose to divvy up your money amongst different types of investments. The following image also shows stable returns from a diversified investment portfolio:

3. Chasing After Hot Tips Does Not Always Make Sense

No matter the source, successful investors never fall for any investment tips. Although tips often pan out, long-term success demands deep-dive research.

So, before investing your hard-earned money, it is also important for you to do your research on a financial instrument. You must dig deeper into the financial instruments and the financial market and pan out a plan accordingly.

4. Having an Open mind is Important

Many big companies are household names in India. However, there is a lack of brand awareness for many other not-so-popular brands in which you can invest your money. Thousands of smaller firms have the potential to become the blue-chip names of tomorrow. Hence, successful investors keep their mind open and take calculative risks to achieve their financial goals.

5. Long Term Investment Planning Gives Better Returns

A long-term investment plan is key for planning the course to be successful. Successful investors develop a long-term investment plan because it serves as a roadmap. When you have a strategy, you can figure out where to put your money, decide when to rebalance your portfolio, and manage withdrawals.

So, you can start by finding out how you want things to end and then work backward. Then figure out which investments and distribution of capital are likely to help you achieve your goal. Accordingly, build a strategy and stick to it to get the most benefits in the longer run.

Successful investors often prove that the right investment decisions can help you create wealth and achieve long-term goals. So, if you want to become experienced in investing your money and make your financial objectives, keep these things in mind to stay on the right track.

If you are new to investing money and are unable to choose the appropriate investment instruments, you can go for reputable financial advisors like FinEdge to help you out with your financial planning.

Image Credit: Economic Times