As an entrepreneur or small business owner in India, you know how critical accurate and up-to-date financial records are to the success of your venture. However, for many, the task of bookkeeping and accounting has been tedious, time-consuming, and rife with human error. The good news is that technology has provided a solution in the form of digital accounting platforms. One such innovative service that is transforming online accounting in India is Khatabook. Launched in 2019, Khatabook provides a digital solution for record-keeping that replaces traditional pen and paper ledgers. The cloud-based accounting app allows business owners to maintain digital accounts, track customer transactions, and reconcile balances, all on a smartphone.

Table of Contents

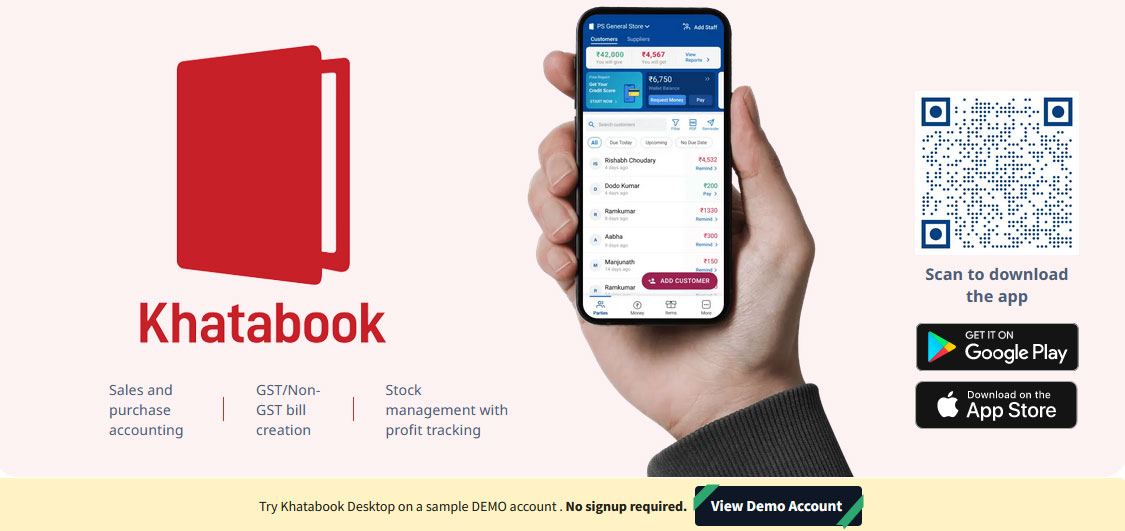

With over 50 million+ downloads, Khatabook is revolutionising how micro, small and medium enterprises (MSMEs) in India do their accounting by saving time, reducing errors, and providing useful financial insights to help grow your business.

What Is Khatabook?

Khatabook is India’s number one free online accounting app, designed to simplify financial management for small businesses. By providing an affordable, user-friendly solution for accounting and financial management, Khatabook is enabling MSMEs across India to improve their productivity, gain valuable business insights, and have greater access to growth opportunities. The app underscores how technology can empower small business owners and boost economic prosperity.

- Khatabook accounting app offers an easy-to-use interface to log expenses, income, customer details, and transactions.

- Khatabook app automatically generates key financial reports like profit and loss statements, balance sheets, customer statements, and tax invoices with just a few taps.

- This cloud based accounting app available on Web, Android and iOS platform.

- Khatabook uses advanced data encryption and authentication protocols to keep your financial information private and secure. All data is synced in real-time and accessible across devices.

The Problems With Traditional Accounting Methods in India

Traditional accounting methods in India have posed several problems for small businesses.

- Firstly, manual bookkeeping is time-consuming and prone to human error. Business owners have to spend hours recording transactions, updating ledgers, and ensuring the books balance. This diverts valuable time and resources away from core business activities.

- Secondly, paper-based records are difficult to access and share. Important financial documents may be misplaced, damaged or destroyed, and remote access is impossible. This lack of transparency and accountability reduces the ability to make data-driven business decisions.

- Thirdly, many small business owners in India have limited accounting knowledge. They rely on accountants to handle their books, often only providing records and receipts at the end of each month. This delay means missed opportunities to identify and fix issues early on.

- Finally, the informal nature of most small businesses in India means many operate largely in cash. Unrecorded cash transactions lead to incomplete financial records, making tax reporting and compliance challenging. This puts businesses at risk of penalties and legal trouble.

In summary, traditional accounting methods are unable to meet the needs of India’s small businesses in today’s digital age. Automated, cloud-based accounting software like Khatabook provides an accessible, affordable solution to these long-standing problems. By simplifying bookkeeping, enabling remote access and real-time reporting, and ensuring accuracy and transparency, online accounting tools are revolutionising how small businesses in India manage their finances.

How Khatabook Simplifies Your Business Accounting

Khatabook is an innovative accounting app that simplifies business accounting for micro, small and medium enterprises (MSMEs) in India. With an intuitive interface, Khatabook is easy to set up and navigate. You can add income and expense entries, track customer transactions, and generate reports with just a few taps. The app works on both Android and iOS, so you can access your accounts anywhere. Some of the key features that make Khatabook an essential tool for business owners and accountants include:

1. Digital Ledgers

Khatabook allows you to maintain digital ledgers for all your accounts including sales, purchases, expenses, and customer transactions. You can record entries on the go and reconcile them with your bank statements to ensure your books are always up to date. This eliminates the need for error-prone manual bookkeeping.

2. Customer Management

The app makes it simple to track your customer transactions and balances. You can add new customers, record payments received, and view account statements. This gives you a clear overview of who owes you money and helps improve cash flow by sending payment reminders.

3. Invoice Generation

Creating professional invoices has never been easier. Khatabook offers a simple interface for generating customised invoices in a matter of seconds. You can add your business logo, include itemised lists with descriptions and rates, specify payment terms, and save invoice templates for repeated use. Invoices can then be sent directly to customers via SMS, email, or WhatsApp from within the Khatabook app.

4. Payment Reminders

Khatabook automatically sends payment reminders to customers with outstanding invoices. You can customise the frequency and content of payment reminders to suit your business needs. Payment reminders are an effective way to reduce late payments and improve cash flow.

5. Expense Tracking

Recording financial transactions is effortless with Khatabook. Business owners or their accountants can quickly log expenses, invoices, and payments using the intuitive interface. Transactions are categorised automatically based on the details entered, saving time that would otherwise be spent on manual categorization and data entry.

Detailed records of business expenses can be logged in Khatabook, including expense date, amount, category, payment method, and notes. Expense tracking helps you gain valuable insights into your business’s spending and make better budgeting decisions. Connect your business bank account to automatically import expenses into Khatabook.

6. Reports and Insights

Khatabook generates useful financial reports including profit and loss statements, balance sheets, customer statements, and tax reports. These reports provide insights into your business performance and help with tax filing and compliance. Owners gain valuable insights into their cash flow, working capital, and key performance indicators to better understand their financial health and growth opportunities. You can also export reports as PDFs to share with your accountant or financial advisor.

7. Simplified Tax Compliance

For MSMEs, managing taxes and ensuring compliance with India’s tax laws can be challenging. Khatabook makes the process simple by tracking income, expenses, invoices, and payments to automatically calculate GST and TDS liabilities. The app generates GST and TDS reports, challans, and returns in the required formats, so business owners avoid penalties and interest due to non-compliance.

8. Data Security and Privacy

Khatabook employs strong data security and privacy practices to keep financial and business information safe. User data is encrypted and stored on secure servers, and regular audits and penetration testing help identify and address any vulnerabilities. Strict access controls and data privacy policies govern how data can be accessed and used.

9. Affordable Pricing

Khatabook offers an affordable subscription model with plans starting at just Rs.2,499 per year. For micro businesses and freelancers, the free plan available for Mobile Users provides enough features to get started with digital bookkeeping.

By digitising your accounting, Khatabook can help streamline your business processes, reduce errors, cut costs, and gain valuable financial insights. For MSMEs in India, it is a simple yet powerful tool for managing your books and staying on top of your finances. The app continues to add new features to better serve small businesses, so you can expect it to become even more useful over time.

How Khatabook Helps With GST Filing and Reporting

Khatabook’s software helps small businesses stay compliant with India’s Goods and Services Tax (GST) requirements. Registering with the GST Network (GSTN) can be complicated, but Khatabook simplifies the process.

Registering for GST

To register for GST, you will need to provide business details like your PAN number, business address, business activity, and annual turnover. Khatabook’s simple interface guides you through submitting the necessary information to the GSTN portal. Once registered, Khatabook will provide your GSTIN number to use for all GST-related transactions and filings.

Filing GST Returns

As a GST-registered business, you must file GST returns on a regular basis to report your sales, purchases, input tax credits, and GST owed or refunded. Khatabook automatically tracks all your business transactions and generates the necessary reports to simplify filing GST returns. You can file GSTR-1 for sales, GSTR-2 for purchases, and GSTR-3B for a summary of returns – all through Khatabook’s interface.

Generating GST Invoices

For every sale, you must provide customers with a GST tax invoice that includes specific details like your GSTIN number, invoice number, customer details, item details, taxes, and total amount due. Khatabook allows you to easily generate customised GST invoices for all your sales. You can add your business logo and print the invoices for customers or share digital copies.

Staying Compliant

Between registering for GST, filing regular returns, and issuing tax invoices, GST compliance can be challenging for small businesses. Khatabook helps ensure you meet all GST requirements to avoid penalties and legal issues. The software provides alerts about upcoming GST deadlines, checks that your invoices include all necessary information, and flags any errors to correct before filing returns. Using Khatabook, you can feel confident your business is GST compliant.

In summary, Khatabook simplifies GST registration, return filing, tax invoicing, and overall compliance for small businesses in India. With an easy to use digital interface, Khatabook helps you understand and meet your GST obligations so you can focus on growing your business.

Conclusion

As you have seen, Khatabook is transforming how small businesses in India manage their accounting and finances. By providing an easy to use mobile app with powerful features like automated bank reconciliation, customer management, and invoice generation, Khatabook makes accounting accessible for all. No longer do business owners need to rely on outdated manual methods or expensive accounting software. With Khatabook, you have a modern solution tailored to your needs that fits in your pocket. The app’s widespread adoption shows how it is revolutionising online accounting in India. If you run a small business in India, Khatabook could be the solution you have been waiting for to simplify your accounting and help your business grow. The future of finance in India is digital, and Khatabook is leading the way.